Tired of the traditional funding routes that seem to stifle your business’s growth? Revenue based funding might be the solution you’ve been searching for. Unlike conventional loans or equity investments, this funding model aligns with your business’s performance, offering a flexible and growth-friendly alternative.

Different business models can benefit uniquely from revenue based funding. Whether you’re running a tech startup or a retail business, this approach can provide the capital you need without the pressure of fixed repayments or diluted ownership. Dive into how revenue based funding can be tailored to fit your specific business needs and propel your venture to new heights.

What Is Revenue Based Funding?

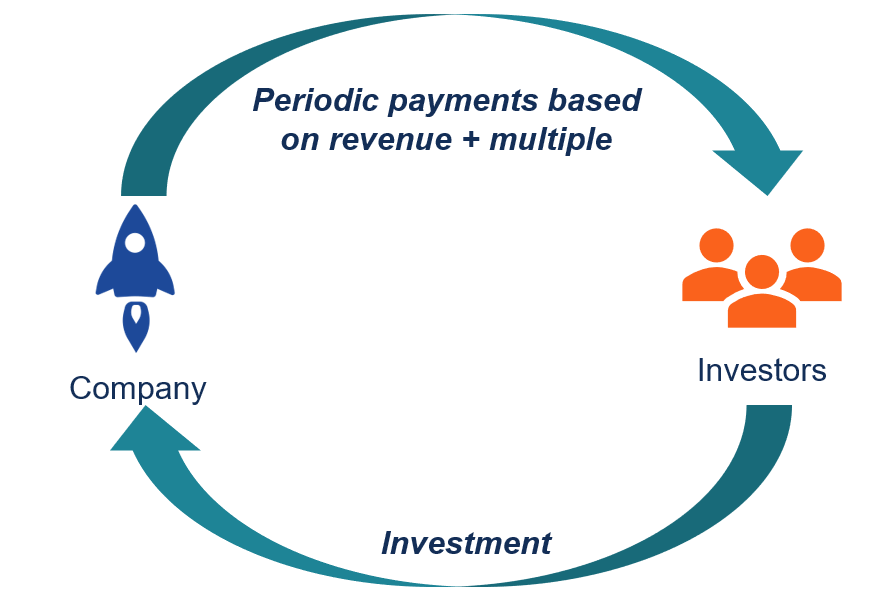

Revenue based funding provides capital in exchange for a percentage of your future revenue. Unlike traditional loans, which come with fixed monthly payments, revenue based funding aligns repayment with your business performance. If your revenue dips, so do your payments, easing pressure during slower periods. This funding model avoids equity dilution, keeping full ownership intact.

With this type of funding, you gain flexibility and growth potential. Rather than worrying about the next repayment, you can focus on scaling your business. It’s particularly useful for e-commerce, SaaS, and subscription-based businesses. Since you pay back a percentage of revenue, the model adapts to your income cycles.

You might wonder how revenue based funding differs from loans. Loans impose strict repayment schedules and interest rates, often stifling cash flow. Equity investment dilutes ownership and relinquishes control. Revenue based funding offers a middle ground, combining the benefits of both without the drawbacks.

Ever considered how seasonality impacts your business? With revenue based funding, payments contract and expand with your earnings, providing breathing room during lean months. This adaptability helps augment stability and growth, setting a foundation for sustainable success.

Benefits of Revenue Based Financing

Revenue based funding has numerous advantages. First, it offers non-dilutive capital, meaning you retain full control of your company. Investors don’t demand ownership; instead, they claim a percentage of future revenue until the agreed amount is repaid.

Second, payments scale with revenue, providing a buffer during slow periods. This makes it easier to manage cash flow and plan for future investments. Businesses often struggle with repayments during downturns, but this model mitigates that risk.

Third, it avoids the pitfalls of conventional funding. Loans come with fixed payments and interest rates, sometimes causing financial strain. Equity investment can dilute ownership, leading to a loss of control. Revenue based funding blends positives from both, offering capital without these limitations.

Think of how easier it gets to manage unexpected expenses with this model. No fixed repayment schedule means business growth remains the priority. When revenue spikes, repayment accelerates, reducing the time it takes to clear the debt.

Finally, it’s an attractive option for a range of industries. Tech startups, e-commerce businesses, and subscription services particularly benefit. The model aligns well with cyclical revenue streams, helping businesses figure out through variable income phases.

Have you ever thought about how your funding choice impacts your business scalability? Revenue based funding fuels growth without clipping your wings. Whether you’re a startup or an established business, flexible repayments and non-dilutive capital can be game-changers.

Types of Business Models Benefiting from Revenue Based Funding

E-Commerce Ventures

E-commerce ventures thrive with revenue based funding. Your online store might generate varying income, yet you need steady growth capital. This model adapts to sales cycles, providing funds when sales are brisk and easing during slow months. It’s perfect for handling inventory, marketing and operational costs. A revenue based approach also reduces pressure from fixed loan repayments or equity dilution, keeping your profit margins intact. Can you think of a better way to support flexible business growth?

SAAS Companies

SaaS companies often face substantial initial development costs. Revenue based funding offers funds swiftly, already aligned with your subscription revenue. As you gain more customers, repayments scale with your income, not a predetermined schedule. You’ve got control without giving up equity or steering your company’s direction. Ever wondered how to match your funding needs with your recurring revenue? This could be it.

Subscription Based Services

Subscription-based services benefit from predictable revenue. With periodic income streams, revenue based funding aligns perfectly. Your fitness app or streaming service might need capital to expand, yet avoiding equity sales is crucial. The flexibility here means repayments mirror the success of your subscriber base. So why miss out on growth opportunities when you can keep your ownership intact?

Evaluating Criteria for Revenue Based Funding Eligibility

Revenue based funding hinges on specific performance metrics. You might ask, what counts the most? First on the list is your monthly recurring revenue. For instance, if you run a SaaS or subscription service, consistent income reveals stability. Customer acquisition cost is another key metric. Lower costs suggest efficient marketing and sales channels, making your business more attractive to investors.

Churn rate plays a significant role. Are customers sticking around or leaving after a month? A low churn rate indicates customer loyalty which reassures funders. Then, there’s the lifetime value of your customers. If each customer generates significant value over time, your revenue potential increases.

Best Practices for Managing Revenue Based Funding

Planning ensures your funds serve your business objectives. Start by outlining your goals. Do you aim to expand your product line, increase marketing, or hire more staff Turn your objectives into a detailed plan. You might allocate a portion for immediate needs like inventory. Another chunk could support long-term growth like technology upgrades or new hires.

Break down your budget. Know what every pound supports. This helps avoid misallocation. Prioritise high-impact areas first. Marketing often provides quick returns but investing in staff builds capacity. Think of growth stages. Align your funding with business milestones, not just immediate needs.

Monitoring and Reporting Revenue

Track revenue consistently. Use tools that provide real-time data. Accounting software like QuickBooks or Xero integrates easily with sales platforms. Regular monitoring helps spot trends. You’ll notice seasonal fluctuations or identify consistent performers.

Set benchmarks. Compare actual performance against forecasts. What deviations do you see Look at both positive and negative variances. If revenue exceeds expectations, explore the causes. Underperformance requires immediate action.

Share regular reports with stakeholders. Transparency builds trust. Clearly present the financial health of your business. Quarterly meetings help keep everyone aligned. Adapt strategies based on feedback. Ensure your reporting highlights key metrics like monthly recurring revenue and customer lifetime value.

Profit and loss statements, balance sheets, and cash flow statements are essential. Pay attention to profit margins and operational efficiency. These documents give a snapshot of your financial position.

Emphasise accuracy and timeliness in data collection. An informed approach to managing resources ensures that your business, regardless of its model, thrives with revenue based funding.

In Closing

Revenue based funding offers a versatile solution for various business models, particularly e-commerce, SaaS, and subscription-based ventures. By aligning funding with your revenue, you can fuel growth without giving up equity. Eligibility hinges on key metrics like monthly recurring revenue and customer lifetime value, making it essential to maintain accurate and timely data.

Effective management involves strategic planning and careful use of funds. Monitoring revenue with real-time tracking and comparing actual performance against forecasts ensures you stay on course. Regularly sharing detailed reports with stakeholders fosters transparency and trust.

When managed well, revenue based funding can be a powerful tool to help your business achieve its milestones and drive sustainable growth.